Company identification

Company identification contents

Corporate Outline

December 31,2023

| Established | December 15th,1938 |

|---|---|

| Paid-in capital | 18,044million YEN |

| Stock information | 30million shares 18,351 shareholders. Tokyo Stock Exchanges Prime Market Fiscal year ends December 31. |

| Business Line | Industrial sewing machines, SMT systems, Household sewing machines. |

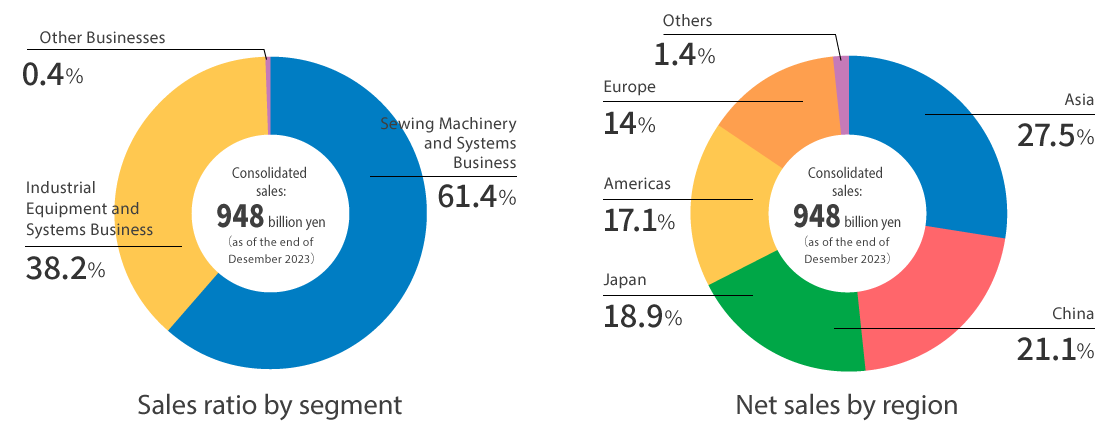

| Annual revenue | ¥948 billion (consolidated basis) (Year ended December 31,2023) |

| Major business office |

Head office (December, 2009) 2-11-1, Tsurumaki, Tama-shi, Tokyo 206-8551 Tel : 81-42-357-2211 Ohtawara plant 1863, Kitakanemaru, Ohtawara-shi, Tochigi 324-0011 Tel : 81-287-23-5111 |

| Number of employees | 4,713 (consolidated basis) |

| Number of affiliated companies | 27(consolidated basis) |

Composition of net sales

Director and Executive Officer

as of April 1,2024

Directors

Akira Kiyohara

Representative Director Chairman CEO & COO

and Representative Director Chairman & CEO of JUKI Automation Systems Corporation and Representative Director Chairman & CEO of JUKI Technosolutions Corporation

and Representative Director Chairman & CEO of JUKI Automation Systems Corporation and Representative Director Chairman & CEO of JUKI Technosolutions Corporation

Shinsuke Uchinashi

Director President

In charge of Global Co-Operate Center (Finance & Accounting Dept. and Logistics Management Dept.) In charge of Group Audit Dept. and in charge of Group Quality Assurance Dept. Internal Control & Compliance Dept.

In charge of Global Co-Operate Center (Finance & Accounting Dept. and Logistics Management Dept.) In charge of Group Audit Dept. and in charge of Group Quality Assurance Dept. Internal Control & Compliance Dept.

Atsushi Narikawa

Director Executive Vice President

Kazumi Nagasaki

Director (Outside)

(Independent Directors)

(Independent Directors)

Yutaka Hori

Director (Outside)

(Independent Directors)

(Independent Directors)

Junko Watanabe

Director (Outside)

(Independent Directors)

(Independent Directors)

Audit & Supervisory Board Members

Masahiko Suzuki

Audit & Supervisory Board Member (Full-time)

Hiroko Nihei

Audit & Supervisory Board Member (Outside)

(Independent Directors)

Minoru Takenaka

Audit & Supervisory Board Member (Outside)

(Independent Directors)

Takashi Yoneyama

Audit & Supervisory Board Member (Outside)

(Independent Directors)

Titled Executive Officer

Hirokazu Nagashima

Executive Vice President

Katsumi Nihei

Senior Managing Officer

Minoru Nitta

Senior Managing Officer

Yutaka Abe

Managing Officer

Jirou Ishibashi

Managing Officer

Kiyoshi Matsumoto

Managing Officer

Hiroshi Anzai

Managing Officer

Keiichi Hashimoto

Managing Officer

Corporate Officer

Tsuyoshi Inoue

Corporate Officer

Tomohiro Takeda

Corporate Officer

Kunio Nukui

Corporate Officer

Shunsuke Yoshida

Corporate Officer

Kenji Nakao

Corporate Officer

Keiichi Uekusa

Corporate Officer

Akira Tsukano

Corporate Officer

Masanori Suzuki

Corporate Officer

Yasuyuki Suzuki

Corporate Officer

Daizo Minami

Corporate Officer

Hideya Sudo

Corporate Officer

Masanori Awasaki

Corporate Officer

Michinari Sougawa

Corporate Officer

Shuichi Nozaki

Corporate Officer

Hidehiko Koike

Corporate Officer